Introduction

Nestled among the Channel Islands, Jersey has earned a reputation as one of the world’s premier jurisdictions for trusts and private wealth structuring. An essential introduction to Jersey Trusts serves as your guide through a sophisticated wealth management structure, offering asset protection, succession planning, and powerful flexibility. This article illuminates every facet, from the legal bedrock and trust setup workflows to trustee duties, tax considerations, and cutting-edge developments empowering high-net-worth individuals, family offices, and their advisors to understand core principles and best practices.

Understanding Jersey trusts

A Jersey trust is a legal construct governed by the Trusts (Jersey) Law 1984, which enables a settlor to transfer various assets such as cash, properties, funds, and even digital assets, into a distinct trust fund held by a trustee for the benefit of named beneficiaries or for specific purposes. The strength of Jersey’s trust framework lies not only in legislative clarity but also in case law and Royal Court precedent, bolstering confidence that the trust will perform as intended. Moreover, as a signatory to the Hague Convention, Jersey enjoys international recognition, making its trusts effective even across borders.

Beyond this strong legal foundation, Jersey Trusts are valued for their capacity to offer a shield of asset protection and structural segregation. By placing assets into an independent trust fund, they generally remain beyond the reach of settlor creditors. When established with non-resident settlors and beneficiaries, the trust tends to remain neutral for Jersey-based taxes, ensuring maximum tax efficiency. Although Jersey has introduced global transparency measures like FATCA and CRS, trust affairs maintain a high degree of confidentiality and remain outside public registers.

Jersey’s trust law supports an impressive range of structure types, from wholly discretionary trusts that grant trustees broad distribution powers, to fixed-interest arrangements, through to non-charitable purpose trusts. Since removing the 80-year perpetuity limit in 2009, Jersey Trusts can continue indefinitely, making them ideal for long-term planning and intergenerational continuity.

Types of Jersey trusts

Discretionary trusts

Jersey offers a diverse suite of trust options tailored to different needs and objectives. Among these, discretionary trusts are some of the most widely used. In this structure, trustees hold the power to determine which beneficiaries receive distributions, how much they receive, and when. This model offers exceptional flexibility, which is especially valuable in multi-generational estate planning, as it allows trustees to adapt distributions to changing family needs or circumstances. However, it also places considerable trust in the trustee’s judgment, since beneficiaries do not have predetermined rights.

Fixed interest trusts

Fixed interest trusts offer beneficiaries clearly defined entitlements, each person receives a specified share of income or capital. These structures are particularly useful where predictability is desired, such as providing for minor children, ensuring spousal security, or delivering defined tax benefits. Once the trust deed allocates shares, the trustee’s discretion is limited, offering a transparent and reliable stream of benefit.

Reserved powers trusts

For settlors wishing to maintain some level of control over the trust without compromising its integrity, reserved powers trusts offer a suitable balance. Typically, the settlor retains specific decision-making rights, such as the ability to amend the deed, appoint or remove trustees, or direct investments. This approach often appeals to entrepreneurial individuals who want oversight while still benefiting from the trust’s legal protection. Careful legal drafting is essential to ensure the trust does not become a sham arrangement and retains its legal validity.

Purpose trusts

When beneficiaries are not involved, purpose trusts fulfil a clearly defined objective rather than distributing to people. These arrangements are used for a wide variety of purposes, from holding shares in a Private Trust Company (PTC) to managing digital or tokenised assets, and even preserving art, environmental or heritage assets. By eliminating the need for natural beneficiaries, purpose trusts enable a more flexible governance structure aligned solely with the trust’s purpose.

Charitable trusts

Charitable trusts are specifically designed to support philanthropic or public welfare goals recognized under Jersey law. Whether funding research, facilitating cultural heritage projects, or supporting education, these trusts are structured to ensure compliance for long-term charitable giving, often qualifying for tax advantages.

Why Jersey stands out as a leading jurisdiction

Jersey’s reputation as a premier jurisdiction for trusts and private wealth is built on a compelling combination of legal certainty, regulatory excellence, and deep industry expertise. With over six decades of experience managing international wealth, Jersey offers clients the reassurance of a stable, sophisticated, and well-regarded financial centre.

A key strength lies in its robust regulatory framework. The Jersey Financial Services Commission (JFSC) enforces high standards of compliance and governance, while the jurisdiction maintains alignment with global norms, including FATF and OECD principles. Jersey is also a signatory to the Hague Trusts Convention, reinforcing its commitment to international legal cooperation and recognition of trust structures.

Jersey’s legal infrastructure is another cornerstone of its appeal. The Royal Court of Jersey has a long and respected track record in trust jurisprudence, offering clients confidence in the consistency, quality, and enforceability of legal outcomes.

Furthermore, Jersey benefits from a concentrated cluster of leading international professional service firms, including trust companies, law firms, accountancy practices, and fund administrators. This ecosystem enables the delivery of multi-jurisdictional solutions with precision and depth, supporting families with complex structuring needs across borders.

From a practical perspective, Jersey offers tax neutrality, no restrictions on trust duration or currency, and strong political and economic stability. These attributes make it a preferred choice for high-net-worth families, institutions, and advisers seeking a reliable base for long-term asset protection, succession planning, and global wealth management.

Setting up a Jersey trust

1. Set clear objectives

The foundation of a successful trust is clarity of purpose. Before drafting any legal documents, the settlor must crystallise their core goals. Common objectives include preserving family wealth for future generations, maintaining privacy, achieving tax efficiency, and supporting charitable causes. These objectives influence every subsequent decision ranging from trust type and trustee selection to deed provisions and governance models.

2. Choose a professional trustee

Under Jersey law, only approved individuals or corporate entities regulated by the Jersey Financial Services Commission (JFSC) can act as trustees. Corporate trustees whether independent or affiliated with banks, provide professional oversight, continuity, and deep expertise in trust administration and global wealth planning. Private Trust Companies (PTCs), often used by wealthy families, combine the benefits of local governance and flexibility, while still maintaining required licensure through a Jersey trustee.

3. Draft the trust deed

The trust deed is a critical legal instrument, carefully woven to reflect the settlor’s intentions. It includes vital elements such as the declaration of trust, identification of beneficiaries or purposes, the trust term, vesting conditions, procedures for revocation or amendment, and any powers reserved by the settlor or protector. Investment guidelines, reporting obligations, and contingency measures including what happens if a trustee retires or a beneficiary predeceases others, must also be clearly scoped to avoid ambiguity or operational challenges.

4. Transfer assets

The trust only becomes effective once assets are legally transferred. Real estate requires deeds and registration; marketable securities often require endorsements or nominee arrangements; and digital assets must be moved into secure custody under the trustee’s control. A thorough title audit or verification of custody arrangements ensures compliance and clear ownership boundaries.

5. Letter of wishes (optional but highly recommended)

To provide functional guidance without limiting legal discretion, a settlor often writes a letter of wishes. This document typically outlines distribution intentions, identifies discretionary priorities, and communicates family values or governance principles. While non-binding, these letters are highly persuasive, especially in discretionary trusts where emotional or relational considerations may guide trustee decisions.

6. Ongoing administration

Once established, the trust requires diligent and structured management. Typically overseen by a professional trustee team, administration includes regular meetings to review investments, ensure regulatory compliance with AML, FATCA, and CRS obligations, and prepare annual accounts for the trust. Trustees must ensure seamless reporting, timely asset valuations, and timely responses to trust-related inquiries. Many modern trustee firms also operate secure online portals, allowing settlors and beneficiaries real-time access to trust documentation, performance reporting, and governance updates reinforcing transparency, governance quality, and ongoing trust alignment.

The roles and responsibilities of Jersey trustees

At the heart of every trust’s success is its trustee, the guardian of both the trust’s assets and its intent. With statutory and common law duties, a Jersey trustee must always act in good faith, putting beneficiaries’ interests first, and administering the trust according to the instrument’s terms. Loyalty is paramount; self-dealing is prohibited, and transparency is required. Impartiality is essential when managing diverse or competing beneficiary interests, unless the trust deed explicitly grants preference rights.

Trustees also bear responsibility for investment discretion and prudence. Typically, they adopt either in-house investment teams or authorised external fund managers, ensuring a suitable mix of assets aligned with risk, return expectations, and the trust’s objectives. Accurate record-keeping is non-negotiable. Each asset movement, valuation, and distribution must be documented and retained, ensuring reviews can be carried out efficiently.

Furthermore, trustees must also comply with all regulatory obligations, including anti-money laundering protocols, FATCA/CRS reporting, and beneficial ownership reporting. In practice, the trustee’s role extends from careful fiduciary stewardship to transparent governance, professional administration, and judicial accountability.

Which type of Jersey trustee is right for you?

Under Jersey law, the trustee holds legal title to trust assets and is bound by fiduciary duties to act in the best interests of the beneficiaries. Choosing the right Jersey trustee is a critical step in ensuring the long-term success of a trust structure. While all professional trustees in Jersey are regulated by the Jersey Financial Services Commission (JFSC), their ownership models can differ significantly with implications for culture, service style, independence, and continuity.

Independent and Privately Owned Jersey Trustees

These are typically boutique trust companies founded and owned by senior practitioners. They offer a high-touch, relationship-driven service and often attract clients seeking discretion, long-term continuity, and access to decision-makers. Many families value the alignment of interest and nimbleness that privately owned Jersey trustees can provide, especially when bespoke structuring or multigenerational planning is involved.

Private equity-backed Jersey trustees

The past decade has seen a rise in private equity investment into Jersey’s trust sector. These trustees benefit from enhanced investment and ability to grow. However, they may operate under return expectations and exit horizons set by financial sponsors. For some settlors, this model offers an attractive blend of scale and sophistication, while others may have concerns around long-term stability, the impact on administration fees and potential changes in ownership.

Bank-owned or financial institution-affiliated trustees in Jersey

Some trustees operate as part of international private banks with a Jersey presence. This integrated model allows for bundled services including banking, investment management, and fiduciary oversight. While appealing for clients looking for a one-stop-shop, it may raise questions around fiduciary independence, particularly where the bank’s proprietary products intersect with the trust’s investment strategy.

Publicly listed trustee groups operating in Jersey

A small number of Jersey trust companies form part of publicly listed groups. These entities offer perceived strength, regulatory transparency, and access to global resources. However, like PE-backed trustees, they may be influenced by shareholder expectations and quarterly reporting cycles. For clients, the key consideration is whether this model supports their need for personalised, long-term fiduciary support.

Common structures

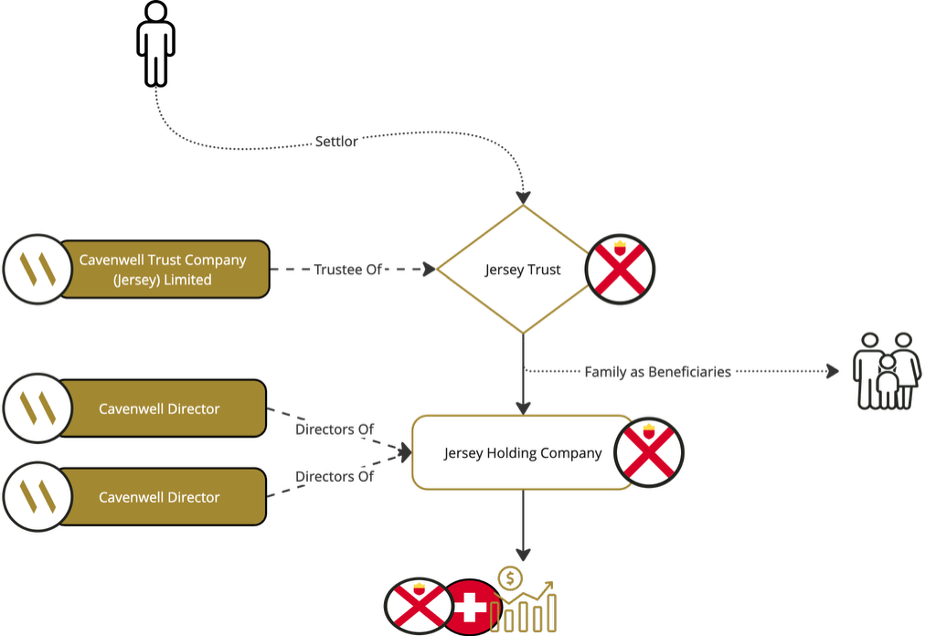

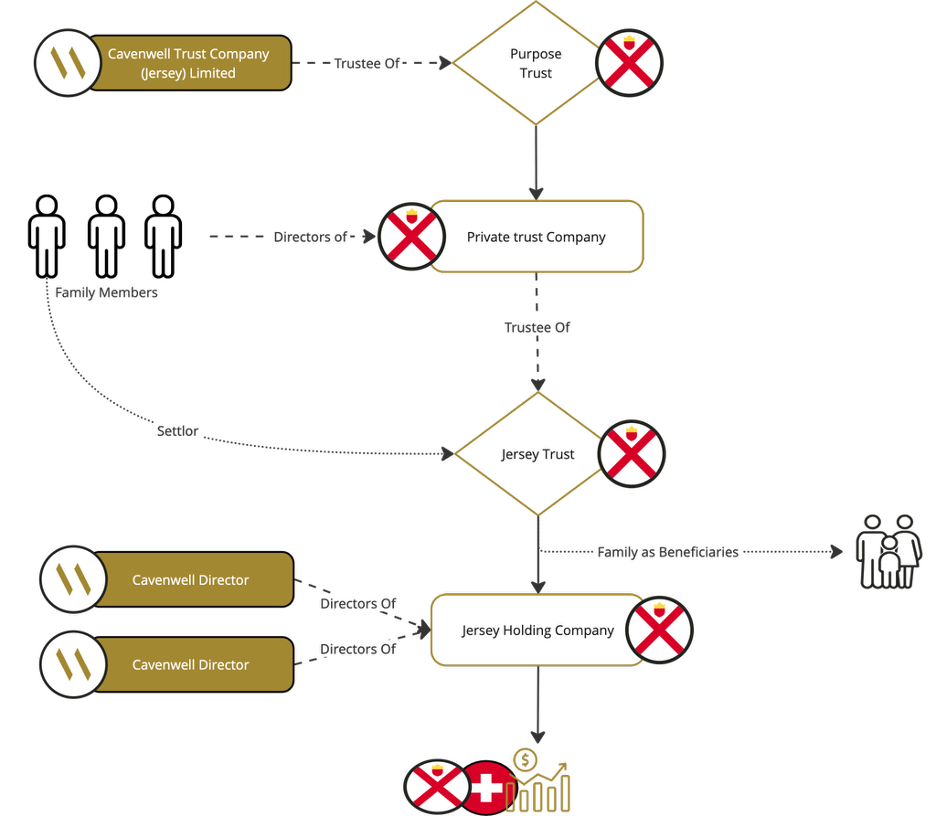

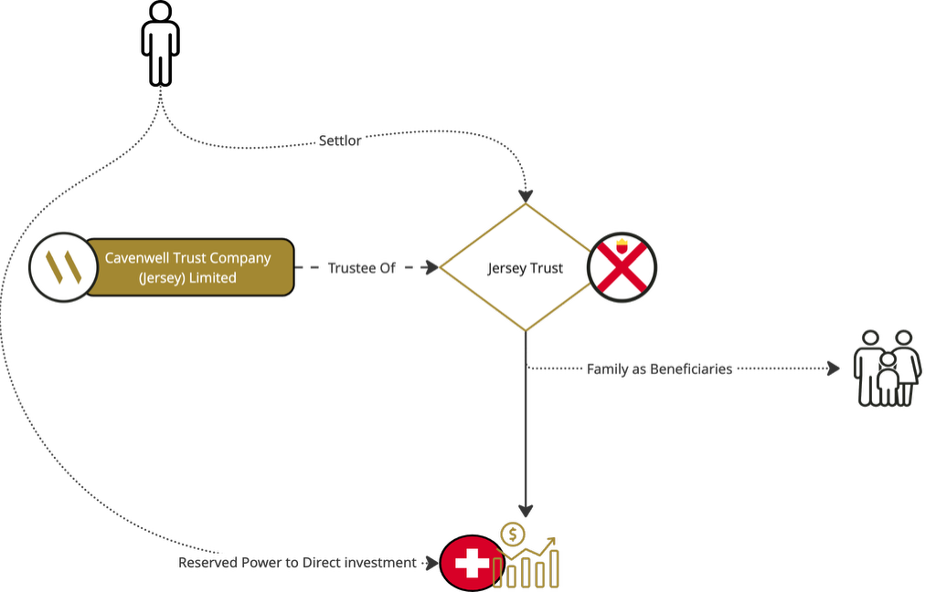

The flexibility of Jersey trust law allows for a wide range of structuring options tailored to different family, commercial, and philanthropic objectives. Below are three commonly used Jersey trust structures, each addressing specific needs such as governance, control, confidentiality, and succession planning.

These simplified diagrams illustrate how assets and responsibilities are typically arranged in each case. While the legal frameworks differ, all structures operate under the supervision of a Jersey trustee and benefit from the robust protection and neutrality of Jersey law.

Structure 1: Basic discretionary Jersey trust

This is the most widely used Jersey trust structure, especially in private wealth and succession planning. The settlor transfers assets into the trust, relinquishing control and legal ownership. The Jersey trustee holds and manages the assets and exercises discretion over how and when to distribute benefits to a class of beneficiaries. The assets may be held directly in the trust, or indirectly via a holding company.

Beneficiaries have no fixed entitlement; instead, the trustee determines distributions based on factors such as need, merit, or guidance from a letter of wishes. This structure is ideal for asset protection, estate equalisation, and long-term planning across generations. It also offers strong insulation from creditor claims and forced heirship regimes.

Structure 2: Purpose trust with Private Trust Company (PTC)

Used frequently by ultra-high-net-worth families and complex multi-branch structures, this arrangement separates legal control from individual beneficiaries. Here, the settlor or trustee establishes a non-charitable purpose trust to hold the shares of a Private Trust Company. The PTC, in turn, serves as the trustee for one or more family trusts.

This model provides governance continuity and control, as the family can sit on the board of the PTC and influence trustee decisions. It can also centralise administration and reduce costs where multiple trusts exist, making it especially effective for families with operating businesses, private equity holdings, or intergenerational succession strategies.

Structure 3: Reserved Powers Trust

In a Reserved Powers Trust, the settlor transfers assets to the Jersey trustee but retains specific powers, commonly the ability to direct investments, appoint or remove beneficiaries, or amend the trust deed. This structure is especially attractive to settlors who wish to retain a degree of influence over the trust without undermining its legal integrity.

Reserved powers must be carefully drafted to avoid the trust being recharacterised as a sham or treated as transparent for tax purposes. When used appropriately, this model offers a balance between professional administration and retained settlor oversight, making it a popular choice among entrepreneurs, founders, and family business leaders who wish to take a more active role.

Case study examples: How Jersey trusts are used in practice

Jersey trusts offer exceptional flexibility and are used globally by families and entrepreneurs for succession, governance, and philanthropy. The following illustrative case studies highlight how different Jersey trust structures can be tailored to meet diverse objectives, from consolidating international holdings to embedding family values across generations.

Family Office Holding Structure

Objective: Consolidating global assets under one robust legal and governance framework to reduce the complexity of intergenerational wealth transfer.

A Middle Eastern family with a growing family office required a sophisticated structure to manage its global investment portfolio, including European real estate, a private jet, and equity stakes across several jurisdictions. With four family members and multiple ownership layers, succession planning had become increasingly complex.

A Jersey purpose trust was used to own a Private Trust Company (PTC), which acted as trustee for a series of underlying discretionary trusts, each aligned with a different branch of the family. This architecture provided a clear governance framework, continuity across generations, and a single point of oversight. The PTC’s board, made up of family and independent directors, ensured alignment without sacrificing control.

By consolidating ownership through a Jersey structure, the family reduced compliance friction, protected confidentiality, and created a unified platform for long-term stewardship.

Dynastic Wealth Planning

Objective: Preserving wealth while promoting responsibility and values in future generations.

A Singaporean patriarch approaching retirement wanted to safeguard his family’s wealth while avoiding a culture of entitlement among his descendants. He opted for a Jersey discretionary trust with distribution criteria tied to education, employment, and community engagement.

Rather than setting rigid rules, the settlor wrote a Letter of Wishes outlining the family’s values and hopes for the future. A professional protector was appointed to provide oversight and balance.

Over time, the trust evolved into more than just a financial vehicle. It became a governance tool that reinforced personal responsibility and purpose. Grandchildren no longer expected passive inheritance and instead began pursuing meaningful careers, understanding that their involvement with the trust’s wealth would be earned, not assumed.

Philanthropic Legacy

Objective: Establishing a permanent, internationally compliant vehicle for charitable giving.

A tech entrepreneur based in the UAE wanted to create a lasting impact through structured giving in the arts and education sectors. His existing philanthropic efforts were fragmented and lacked governance.

He settled a Jersey charitable trust with a mandate to support arts education for Arabic-speaking youth. Capitalised with proceeds from his private investments, the trust was overseen by an advisory panel including educators, family members, and fiduciary professionals. Governance protocols ensured impact-based grantmaking and annual reporting.

Jersey’s regulatory clarity and tax neutrality allowed the philanthropist to scale his giving internationally, without the administrative burden of setting up local structures in each jurisdiction. The trust continues to operate in alignment with his original vision, providing a lasting philanthropic platform.

Tax and compliance considerations

While Jersey taxes remain dormant for trusts with non-resident parties, compliance with FATCA, CRS, and local tax obligations remains essential. The trust must identify and report relevant US persons, associates with CRS countries, and verify compliance with global reporting standards. Beneficiaries based in jurisdictions like the UK or US may trigger inheritance tax or grantor trust rules. Regular advice from international tax advisors is therefore advisable, to ensure full compliance and best structuring.

Evolving landscape and emerging trends

Jersey continues to adapt to global wealth management trends. New regulatory measures bolster AML frameworks, while economic substance requirements align with international tax standards. Jersey is positioned to support alternative assets, including crypto and digital holdings, for trustees with experience of the asset class like Cavenwell. The jurisdiction is also refining its position in areas like family investment companies and digital economy alignment, ensuring that future innovation continues to flow through its channels.

Conclusion

For anyone seeking to protect multi-generational assets, structure philanthropic legacies, safeguard against financial threats, or manage complex international portfolios, Jersey Trusts provide a trusted legal and financial framework. Partnering with experienced Jersey trustees, professional legal advisors, and international tax consultants ensures that your trust functions soundly, evolves with your needs, and meets all legal and regulatory obligations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

While these documents are accurate as of the date of issue, they may be subject to change in the future should the JFSC update its guidance or requirements

FAQs

Who is eligible to serve as a Jersey trustee?

Professional Trustees must be Jersey-licensed individuals or corporate entities regulated by the Jersey Financial Services Commission, ensuring legal authority and fiduciary competency.

Can the settlor also be a beneficiary?

Yes, Jersey permits settlor-beneficiary trusts, though this can affect tax and creditor protection depending on the jurisdictions involved.

Are Jersey Trusts public?

No. Trusts are not publicly registered; however, regulators maintain access to private registers held by trustees, and disclosures are made only to authorised authorities under specified circumstances.

How long can a Jersey Trust last?

Trusts can endure indefinitely, following changes in 2009 that removed perpetuity terms, or they can be established for defined periods.

Are all trusts subject to mandatory audits?

No, private, family trusts typically require standard administration and reporting.