What is an SPV?

A Special Purpose Vehicle (SPV) is a legal entity created for a specific purpose, such as isolating financial risk, raising capital, or holding assets. SPVs are commonly established in Dubai by a wide range of entities, including private clients, corporations, and investment funds. Private clients typically use SPVs as Dubai Holding Companies to protect personal assets from creditors, achieve tax efficiency, or facilitate estate planning. For instance, an SPV might be used as a property holding company or a holding company for a business, with the shares of the SPV transferred to a trust or directly to heirs, which may reduce tax liability and simplifying the transfer process.

Corporates and investment funds use SPVs to access funding, diversify portfolios, or protect core assets. For example, an SPV might be set up to issue debt or equity securities to finance a project or acquisition, thereby lowering the cost of capital and reducing risk exposure.

What are the uses of a Dubai SPV?

Dubai SPVs are versatile and flexible legal entities that can serve various purposes for different types of investors, including high-net-worth individuals, fund managers, and corporations. Common uses include:

- Creating Holding Companies: A Dubai SPV can hold shares, intellectual property, real estate, or other high-value assets, providing tax efficiency, asset protection, and ease of transfer.

- Participating in Syndicate Deals and Co-Investments: SPVs enable groups of investors to pool funds and invest in a single target, such as a startup, project, or acquisition, reducing risk, cost, and complexity.

- Structuring Family Offices and Estate Planning: SPVs can segregate ownership interests among family members, facilitating the succession and distribution of wealth.

- Entering Joint Ventures: SPVs act as vehicles for collaboration between parties, defining each party’s rights and obligations.

- Issuing Securities and Raising Capital: SPVs can access capital markets and issue debt or equity instruments to finance activities or objectives.

One of the best options for an SPV in Dubai is the DIFC Prescribed Company, which offers a low-cost, fast, and simple setup process, along with a range of benefits for investors.

DIFC Prescribed Company for Dubai SPVs

The DIFC Prescribed Company is an excellent choice for setting up an SPV in Dubai due to its numerous advantages:

- Low Setup and Maintenance Costs: Compared to a normal DIFC operational license, the cost of setting up and maintaining a DIFC Prescribed Company is significantly lower.

- No Office Space Requirement: The company can appoint a DIFC registered Corporate Services Provider, such as Cavenwell Group, to provide its registered office.

- Tax Benefits: The company enjoys 0% taxation on dividends and qualifying income and has access to the DIFC’s network of double taxation treaties.

- Privacy Protection: There is no public register of beneficial owners, and the DIFC respects proportionate privacy. A Foundation can be used to enhance privacy, with only the Foundation’s name being public.

- Legal Certainty and Efficiency: Operating under the English common law-based legal system of the DIFC, the company benefits from more flexibility and innovation than other UAE free zones.

- Share Classes and Shareholder Agreements: The company can issue multiple share classes, establish enforceable shareholder agreements, and use instruments such as SAFEs (Simple Agreements for Future Equity).

- Managing Office License: It can obtain a license for a managing office to provide management services to its subsidiaries.

- UAE Residence Visas: In certain cases, the company can issue UAE residence visas.

Key considerations for setting up a DIFC SPV

A DIFC Prescribed Company also has some requirements that need to be considered before setting one up, such as:

- Passive holding entities: A DIFC SPV cannot engage in active commercial activities, such as trading, manufacturing, or providing services. It can only hold assets, such as shares, properties, or intellectual property.

- Eligibility criteria: A DIFC SPV must meet one of the following conditions:

- It is controlled by one or more GCC citizens or entities controlled by GCC citizens;

- It is controlled by one or more DIFC registered entities (which could include a DIFC Foundation);

- It is established to hold a GCC registerable asset, such as a GCC company or property;

- It is established for a qualifying purpose, such as Aviation structure, Maritime structure, Intellectual property structure, Structured financing, or Crowd funding structure.

- If none of the criteria can be met, then the DIFC prescribed company can still be established if a Director is appointed to the entity from a DIFC Corporate Services Provider, such as Cavenwell.

- Registered office: A DIFC SPV must maintain a registered office in the DIFC, which can be that of a corporate services provider.

Dubai SPVs in practice

To illustrate how a DIFC SPV can be used in practice, let us look at some case studies:

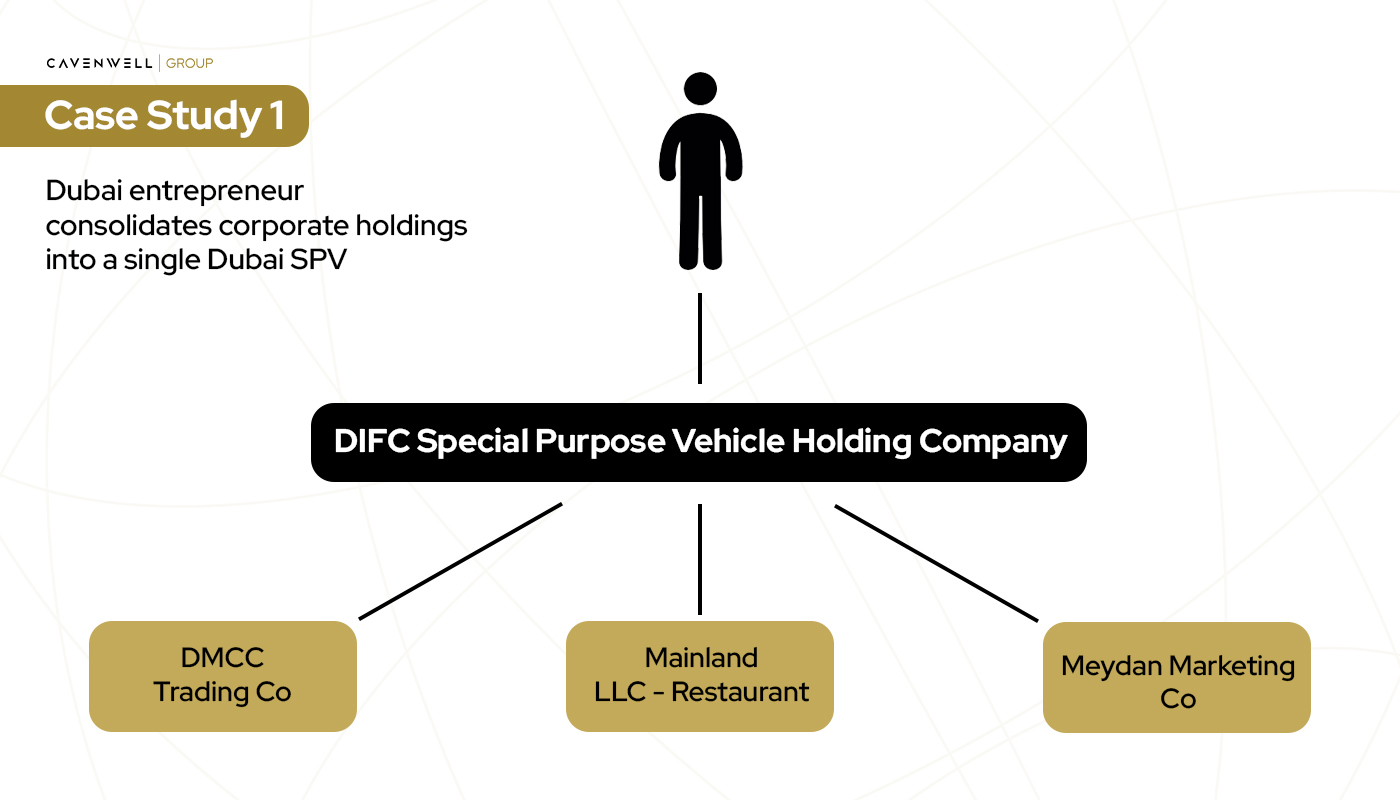

Case Study 1:

Dubai based entrepreneur, seeking to consolidate various corporate holdings into a single holding company for ease of administration.

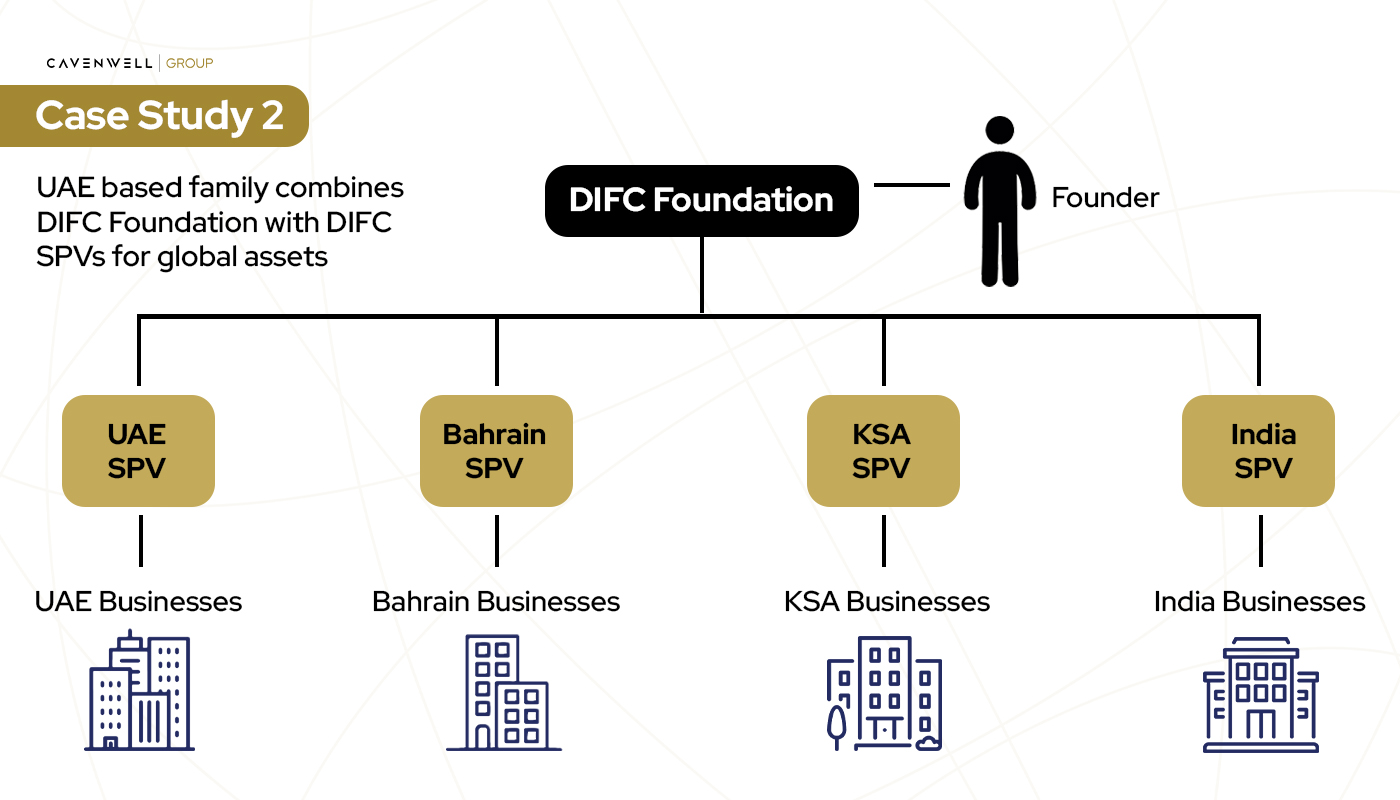

Case Study 2:

UAE based family with various business interests around the globe, establish a DIFC Foundation for asset protection and succession planning purposes, with DIFC Prescribed Companies established as Dubai SPVs to segregate their business interests geographically.

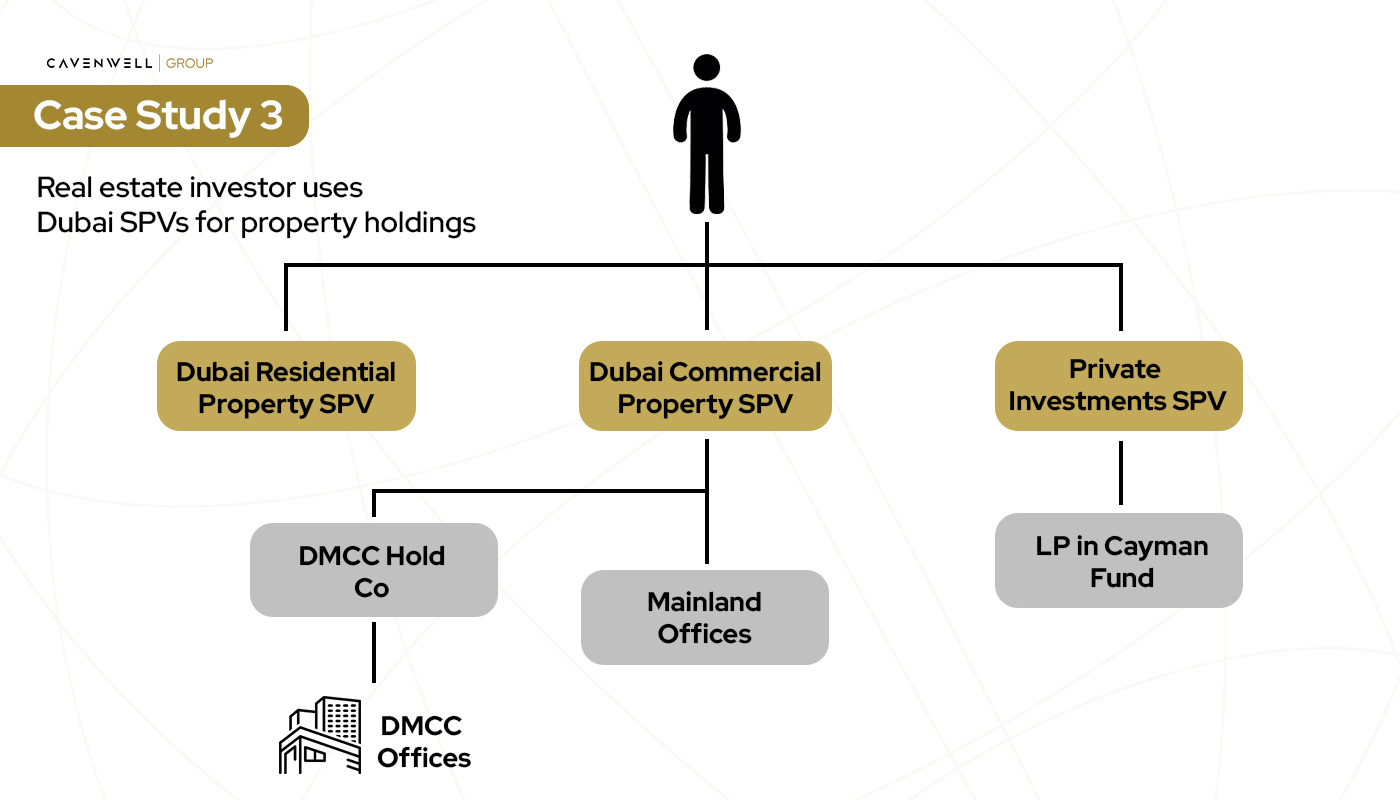

Case Study 3:

International Investor with Dubai property holdings establishes SPV’s to hold his Dubai real estate portfolio and other investment interests.

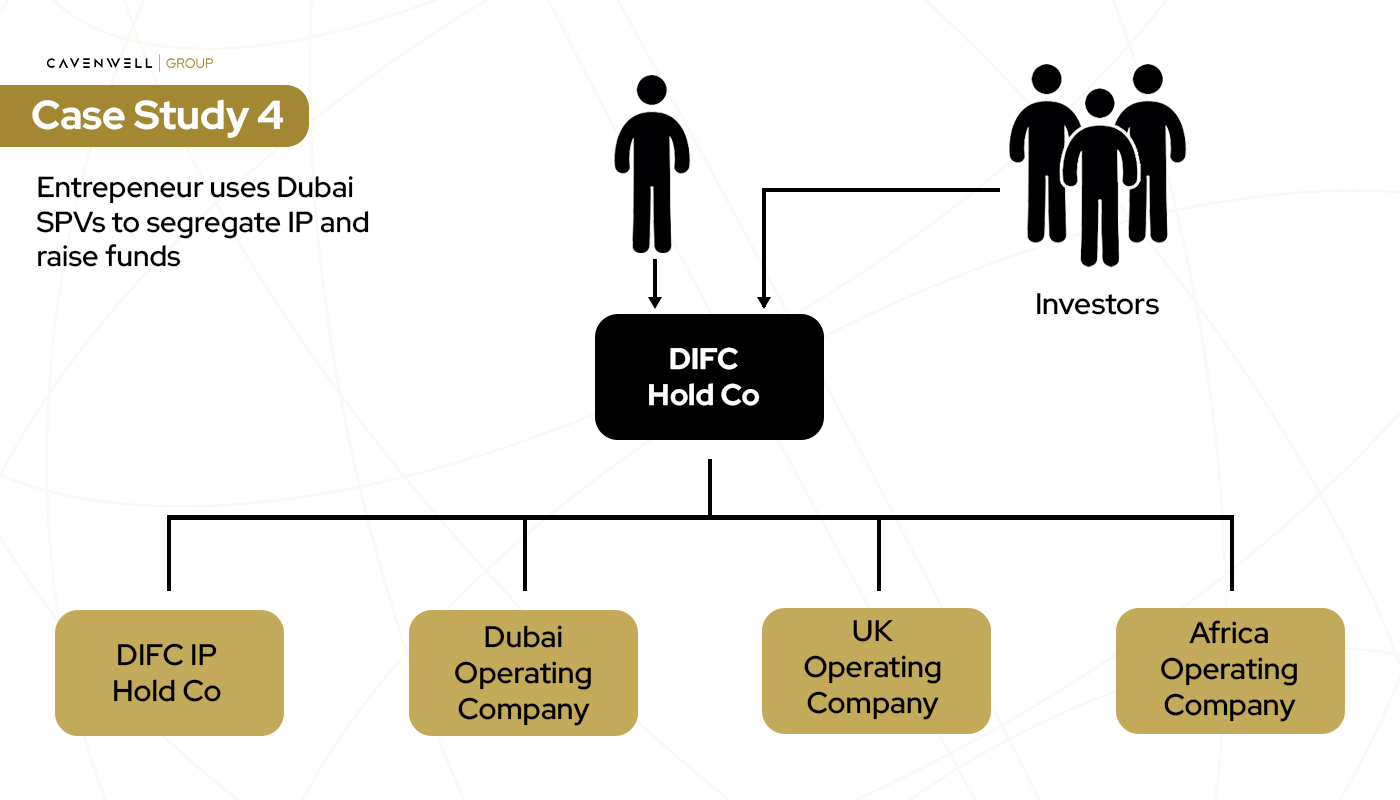

Case Study 4:

Entrepreneur uses Dubai SPVs to segregate Intellectual Property and establish a Holding Company for raising money from Venture Capital funds

Frequently Asked Questions (FAQ)

-

What is the primary benefit of using an SPV?

The primary benefit is risk isolation, allowing the parent company or shareholder to protect themselves from financial exposure related to specific projects or investments.

-

Can an SPV engage in multiple business activities?

Yes, an SPV can engage in various activities, but these must align with its specific purpose as outlined during its establishment. If the activity is not a qualifying purpose, the entity must be a holding company.

-

Are there tax advantages to setting up an SPV in Dubai?

Yes, Dubai offers a favorable tax environment, particularly within the DIFC, making it an attractive location for SPVs. There is the ability for dividend income and other qualifying income to be taxed at 0%, and a wide range of double taxation agreements.

-

What are the regulatory requirements for maintaining an SPV in Dubai?

SPVs must comply with DIFC regulations, including the appointment of a registered agent and maintaining a registered office within the DIFC.

-

Can an SPV be used for international investments?

Yes, SPVs can facilitate international investments, providing a flexible and efficient structure for cross-border transactions.

-

What is the best option for a Dubai SPV?

Whilst there are many freezones in Dubai within which an SPV can be established, DIFC is the only common law jurisdiction and is the most preferred option.

-

What is the cost of a Dubai SPV?

The DIFC Prescribed Company fees are $100 for application and $1000 for annual licensing. Additional costs for the appointment of a corporate services provider must also be considered.

-

How can I set up a Dubai SPV in DIFC?

Get in touch with the Cavenwell team and we’ll assist you throughout the process. As one of only a small number of DIFC registered corporate services providers, we can also be your appointed corporate services provider and provide your registered office in the DIFC.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.